The medium to long term goal of each company is to grow and generate positive cash flows at the end of the year in order to be self-sustainable and remunerate shareholders.

One of the ways to achieve this is to keep the overall costs (operational, financial, tax) lower than the revenue that the company is able to generate, in order to generate a net profit at the end of the year that is usually reinvested to grow the company further or redistributed to shareholders in the form of dividends.

The purpose of this type of article that you find here on BullDude.com is to discover some stocks that in the last 5 years have been able to strongly increase their profits.

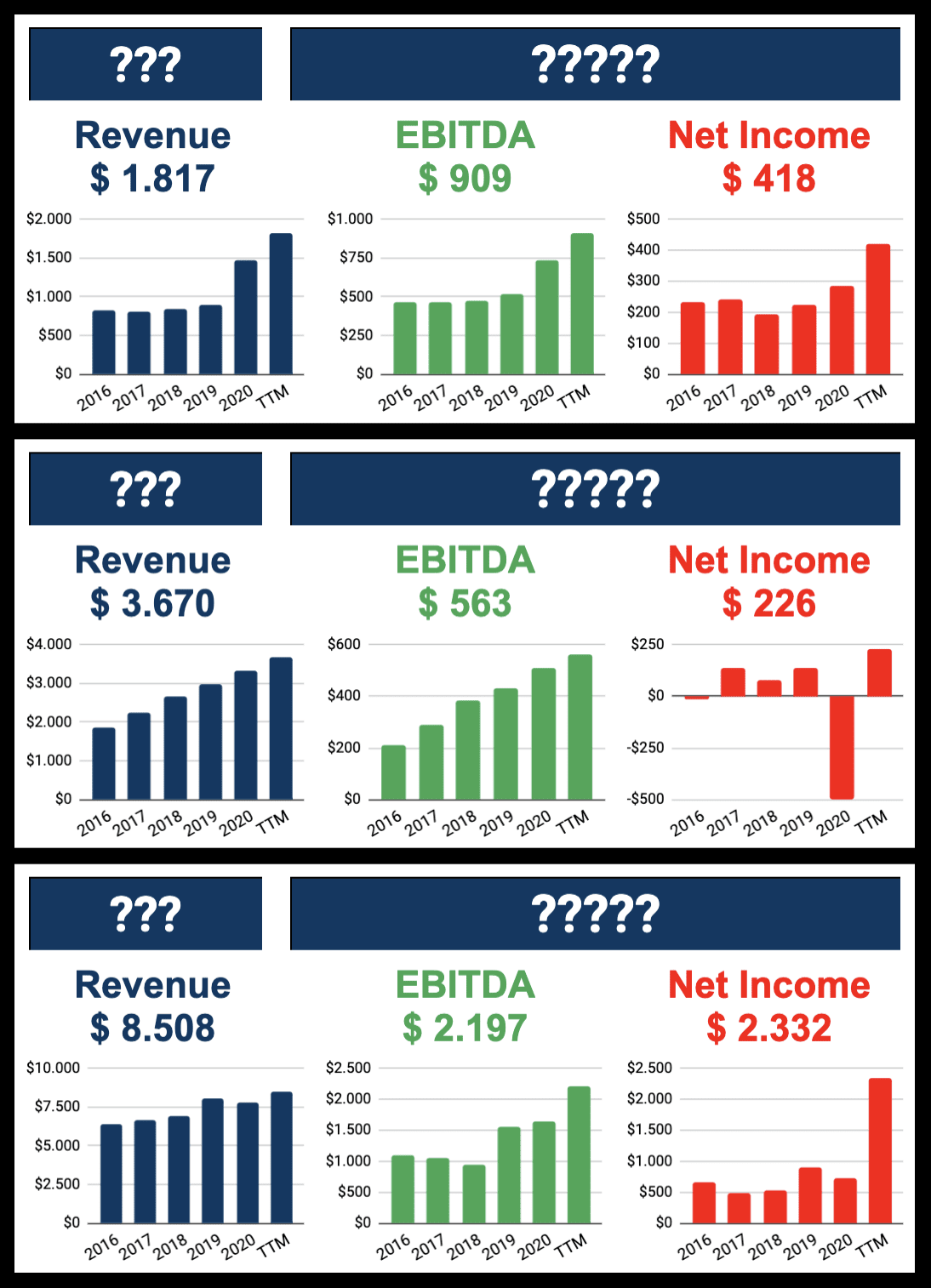

For each of the stocks covered by this analysis, the main key data are shown in the following tables:

- General Information and Key Business Data

- Key Business Data Charts

- Valuation Multiples and Business Margins

1. General Information and Key Business Data

In the first part of the following table you will find general information such as the industry in which the company operates, market capitalization and the performance of the stock price in recent months.

The second part of the following table shows the key business data useful to understand if the company is increasing the size of the business (growing Revenue) and if it is able to generate a profit deriving only from operating activities (positive EBITDA) and also a profit net of all other financial, fiscal and extraordinary costs (positive Net Income).

*Data in Millions of USD

2. Key Business Data Charts

The following table shows the trend of the Key Business Data (Revenue, EBITDA and Net Income) over the last 5 years.

*The EBITDA chart is not present for financial companies

Exclusive Content

for Members

Are you a member? Login

If you are NOT a member keep reading!

EVERYTHING

YOU NEED

FOR YOUR TRADING

In BullDude.com Membership you will find exclusive content in one place:

Best Chart Patterns

Discover the Stocks and Cryptocurrencies that show the best Chart Patterns.

Resistance Breakout, Potential Breakout, Key Moving Average Breakout and Buy The Dip.

Every day, with just one click.

Key Business Data

Find out about stocks with growing Key Business Data and estimates of further future growth.

Earnings Reports

Discover the analysis on the most anticipated stocks that are about to release the Earnings Reports.

Additionally, you can access Pre-Market movers.

What are you waiting for?

Access hundreds of exclusive content with the BullDude.com Membership

* Up to 44% OFF

* Satisfied or Refunded

* Cancel at any time

Exclusive Categories

BullDude.com Membership gives you access to the following 3 categories of exclusive content:

Chart Patterns

This category gives you access to around 60 exclusive articles each month containing the stocks (and cryptocurrencies) that show the most important and effective Chart Patterns every day.

From stocks that show the chart patterns of buy the dip, resistance breakout, trendline breakout and key moving average breakout to those with a chart conformation that increases the chances of making a breakout in subsequent trading sessions.

Go to Chart Patterns category

Stock Analysis

This category allows you to discover every week the key data of various interesting stocks from a business point of view, therefore revenue in strong and constant growth, the ability to produce profits at the end of the year and to grow over time.

Furthermore, the stocks are selected on the basis of the future growth estimates of the 2 main key business data; Revenue and Net Income.

Go to Stock Analysis category

Earnings Reports

This category allows you to access an analysis of the most anticipated companies that are about to release the earnings report in terms of expected earnings growth and other key data. In addition, an analysis of the released results is published at the weekend.

Furthermore, within this category you will find an exclusive article published every day that informs you about Pre-Market movers.

Go to Earnings Reports category

What are you waiting for?

Access hundreds of exclusive content with the BullDude.com Membership

* Up to 44% OFF

* Satisfied or Refunded

* Cancel at any time

What are you waiting for?

Access hundreds of exclusive content with the BullDude.com Membership

* Up to 44% OFF

* Satisfied or Refunded

* Cancel at any time

Everything You Need For Your Trading

In BullDude.com Membership you will find exclusive content in one place:

👉 Best Chart Patterns

👉 Key Business Data

👉 Earnings Reports

* UP to 44% OFF

* Satisfied or Refunded

* Cancel at any time

This article is for informational purposes only. To read the complete disclaimer click here.